The world of tax isn’t what it used to be. Today’s tax professionals manage more documents, stricter regulations, and higher client expectations than ever before. Manual processes no longer suffice, not when clients now demand speed, accuracy, and in-depth insight.

The most recent report from the Future of Professional Report shows that AI’s anticipated workplace impact continues to grow, with 77% of respondents expecting it to have a highly or transformational effect on their work within five years. For tax professionals, it increased to 79%.

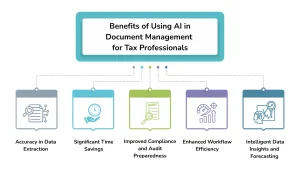

AI is revolutionizing tax work by streamlining how professionals manage financial data, boosting efficiency, improving compliance, reducing risk, and enabling strategic advisory services. This article outlines the top five benefits of AI in document management and offers actionable insights for tax professionals.

1. Accuracy in Data Extraction

AI document management tools achieve superior accuracy in extracting and interpreting financial data from receipts, invoices, contracts, and tax returns. Unlike manual entry, which is prone to human error, AI systems leverage machine learning to read and validate information across a wide range of document types and formats.

- Reduced manual errors:AI instantly flags inconsistencies, reducing compliance incidents.

- Intelligent categorization: Documents are automatically sorted into the correct tax categories for faster reconciliation.

- Audit-ready records: Greater precision ensures records withstand regulatory scrutiny.

By minimizing errors, AI empowers tax professionals to deliver more reliable outcomes to clients and focus attention on high-value advisory services rather than rectifying avoidable mistakes.

2. Significant Time Savings

Manual document processing is a notorious time drain—especially during tax season. AI automates data capture, categorization, and verification, significantly reducing the time required for the entire workflow.

- Automate repetitive tasks: Data from hundreds of documents can be ingested in minutes.

- Accelerated turnaround: Tax filings and client deliverables are processed well ahead of deadlines.

- Streamlined reviews: AI identifies anomalies, allowing professionals to spend less time searching and more time advising.

With intelligent automation, firms achieve improved productivity, enabling them to scale services and support more clients without increasing their headcount.

3. Improved Compliance and Audit Preparedness

Navigating the ever-changing landscape of tax regulations is a challenge for any professional. AI-driven systems stay current with the latest legal requirements and flag potential compliance risks before they escalate.

- Automatic rule updates: AI platforms are regularly updated to reflect new laws and regulations.

- Proactive audit risk reduction: AI highlights potential audit triggers like mismatched data or unusual transactions.

- Thorough documentation: End-to-end audit trails make it easy to validate processes and decisions.

This combination of proactive monitoring and robust documentation substantially lowers the burden and stress associated with audits, positioning firms as trusted partners to their clients.

4. Enhanced Workflow Efficiency

Beyond document extraction and compliance, AI transforms overall workflow management, removing friction and making day-to-day operations more agile.

- Seamless integrations: AI connects with popular tax software, CRMs, and document storage platforms, centralizing information in one place.

- No-touch processing: “No-touch” concepts enable documents to move from receipt to reporting with minimal human intervention.

- Customizable automation: Intelligent bots handle repetitive tasks such as reminders, document requests, and status updates.

This not only streamlines internal operations but also delivers a more consistent, responsive experience to clients.

5. Intelligent Data Insights and Forecasting

AI does more than just organize and secure documents—it uncovers critical insights and forecasts future trends that inform better business decisions.

- Predictive analytics: AI analyzes historical client data to identify patterns, forecast liabilities, and optimize tax strategies.

- Custom reporting: Tailored dashboards offer real-time insights into workloads, deadlines, and client needs.

- Advisory enablement: Insights derived from AI help professionals provide proactive advice and strategic planning, fortifying client relationships.

With richer data at their fingertips, tax experts can deliver more strategic, personalized guidance—driving client value far beyond traditional compliance services.

Case Study Spotlight

A mid-sized tax consultancy was facing increasing challenges managing large volumes of client documents during peak tax season. Their manual processes led to frequent errors, slower client onboarding, and difficulties keeping up with complex compliance requirements. Tax professionals found their time consumed by administrative tasks rather than advisory work.

To address these issues, the firm partnered with Nablasol to implement an AI-powered document management solution integrated with their tax software and CRM platforms. The solution used advanced machine learning to:

- Automate the extraction and validation of financial data from diverse documents such as receipts, invoices, contracts, and tax returns—significantly reducing manual errors.

- Automatically categorize and validate documents into appropriate tax categories, speeding up reconciliation and review workflows.

- Enable seamless client onboarding through AI-powered autofill and secure e-signature workflows, improving client experience and reducing delays.

- Provide built-in audit trails and keep compliance monitoring aligned with evolving tax regulations to reduce risk and improve audit readiness.

- Streamline internal workflows by integrating document management with CRM and tax filing systems, freeing up tax professionals to focus on higher-value advisory services.

Frequently Asked Questions (FAQ)

How does AI improve accuracy in tax document processing?

AI uses sophisticated algorithms to read, classify, and extract data, minimizing clerical mistakes and ensuring consistency across different document types.

Can AI reduce audit risks for tax professionals?

Absolutely. AI instantly flags anomalies and enforces audit trails, making it easier to spot issues before regulatory filings—significantly mitigating the risk of audits or penalties.

What types of documents can AI automate for tax tasks?

AI tools handle tax returns, invoices, receipts, contracts, spreadsheets, workpapers, and many other formats—digitizing both structured and unstructured data sources.

Is AI secure for sensitive tax documents?

Yes. Modern AI document management solutions use robust encryption and access controls and are regularly audited for compliance, ensuring sensitive information stays protected.